Get Funds Quickly: No Credit Check, Interest-Free Loans!

In today’s fast-paced world, unexpected financial needs can catch us off guard. Whether it’s for emergency medical expenses, home repairs, or other personal financial needs, a lack of funds can create significant stress. But now, you have a new solution: no credit check, interest-free loans to help you tackle urgent situations with ease!

What Are No Credit Check, Interest-Free Loans?

This type of loan allows you to apply without undergoing traditional credit checks, making it especially suitable for those with poor credit or no credit history. The interest-free feature means you can quickly access the funds you need without incurring extra burdens.

How to Apply for No Credit Check, Interest-Free Loans

1.Choose a Reputable Lender: Select a loan company that is certified by OLA (Online Lenders Alliance) to ensure they are compliant and legitimate.

2.Prepare Your Documents: Typically, you will need to provide basic documents such as personal identification and proof of income.

3.Fill Out the Application: Complete and submit the online application form, providing the necessary information.

4.Wait for Approval: Most lenders will complete the review within minutes and notify you of the result quickly.

5.Receive Your Funds: Once approved, the funds will be available in your account the same day, allowing you to use them immediately.

Important Considerations

Understand OLA: OLA (Online Lenders Alliance) is an organization focused on the online lending industry, aiming to enhance transparency and protect consumer rights. Choosing a lender certified by OLA ensures you receive reliable loan services.

Read the Terms Carefully: Before signing any loan agreement, ensure you understand all terms, including repayment periods, fees, and penalties.

Assess Your Repayment Ability: Evaluate your financial situation to ensure you can repay the loan on time and avoid future financial troubles.

Choose the Right Loan Amount: Apply for a loan based on your actual needs, avoiding borrowing more than necessary to reduce unnecessary burdens.

Maintain Communication: If you encounter difficulties during repayment, contact the lender promptly to discuss possible solutions.

Avoid Multiple Applications: Applying to multiple lenders in a short period can affect your credit record; it’s best to choose one reliable institution to apply with.

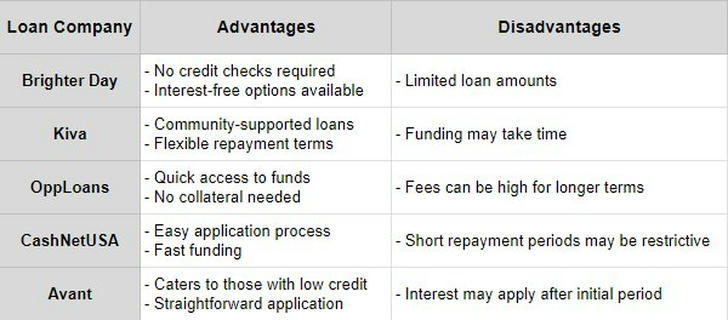

Comparison of companies offering interest-free, no credit check loans

Conclusion

No credit check, interest-free loans offer a convenient way to access funds, especially in emergencies. This loan type not only alleviates credit pressures but also provides flexible options. Before applying, make sure to understand the terms and the advantages and disadvantages of different loan companies.

In financial distress, timely funding support is key to resolving issues. Take action now and apply for no credit check, interest-free loans to keep your finances flowing and live worry-free!